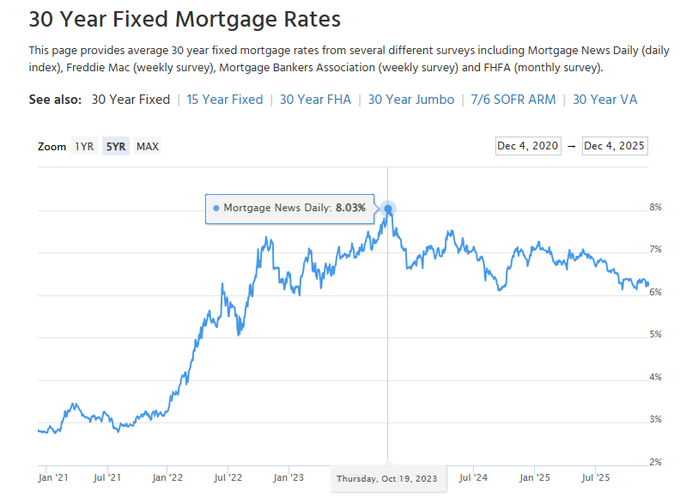

What are the mortgage rates today? After the Federal Reserve’s third consecutive 25-basis-point cut on December 10, bringing short-term rates to 3.5-3.75%, 30-year fixed mortgage rates hover around 6.19%—near 2025 lows but still elevated amid inflation concerns and a softening jobs market.

Fed’s December Decision Impacts What Are the Mortgage Rates Today

The Fed’s 9-3 vote marked rare dissent, with updated projections showing reluctance for further cuts in 2026. Chair Jerome Powell emphasized a “wait-and-see” approach, noting housing remains problematic due to low supply and pandemic-era rate lock-ins. What are the mortgage rates today won’t shift dramatically from this neutral stance, as long-term rates follow Treasury yields more than Fed funds.

Powell highlighted structural shortages: “Housing is going to be a problem,” with limited tools to fix inventory. Inflation at 3% exceeds the 2% target, while tariffs may have caused temporary spikes now cooling. Labor market weakness drives caution—what are the mortgage rates today could edge higher if jobs data disappoints.

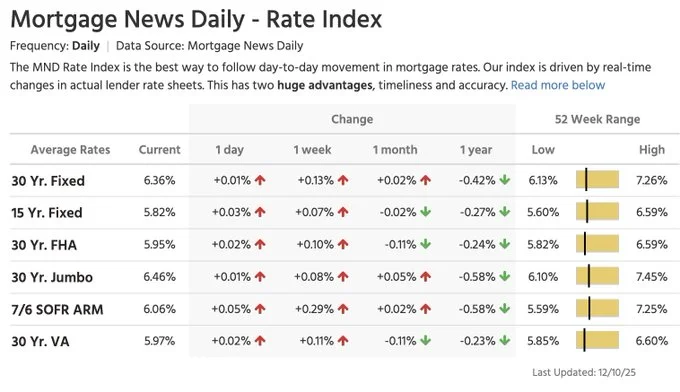

Current Mortgage Rate Snapshot: What Are the Mortgage Rates Today

| Loan Type | Rate | Change |

| 30-Year Fixed | 6.19% | -0.05 pts |

| 15-Year Fixed | 5.62% | Stable |

| 5/1 ARM | 5.89% | -0.10 pts |

| FHA 30-Year | 6.05% | Stable |

Freddie Mac weekly survey, week ending Dec. 5—what are the mortgage rates today reflect recent drift lower ahead of the meeting, but forward guidance tempers optimism.

What Are the Mortgage Rates Today Mean for Buyers

Low-6% rates improve affordability if home prices stabilize and wages grow. Realtor.com’s Danielle Hale forecasts housing costs dropping below 30% of median income by 2026—the first since 2022—potentially boosting sales from 30-year lows. Bright MLS’s Lisa Sturtevant warns what are the mortgage rates today could rise end-of-year if Fed hawks prevail on inflation.

Keller Williams’ Ruben Gonzalez sees 2026 transition: higher inventory softens competition, though jobs uncertainty curbs demand. William Raveis’ Melissa Cohn eyes January data backlog from shutdowns for potential relief.

Factors Driving What Are the Mortgage Rates Today

- Fed Neutrality: Projections split between holding 3.5%+ or 3-3.5% in 2026 signals pause.

- Inflation/Tariffs: Core cooling but persistent pressures.

- Jobs Market: Weakening prompts cuts but limits further easing.

- Treasury Yields: 10-year at ~4.2% anchors mortgage pricing.

- Lock-In Effect: Homeowners resist selling higher-rate homes.

What Are the Mortgage Rates Today: Buyer’s Action Plan

- Lock Now: Secure sub-6.25% if qualifying; points buy down further.

- Shop Lenders: Compare 3+ quotes—savings average $1,200/year.

- Budget Reality: Factor PMI, taxes, insurance into payments.

- Watch January: Fresh jobs/inflation data could move what are the mortgage rates today.

What are the mortgage rates today offer a window before potential 2026 uptick. Economists predict sales rebound if affordability holds, but structural issues persist. Track Freddie Mac weekly surveys and Fed dots for updates.