The intel stock price prediction 2025 has become one of the most debated topics among investors, especially as many wonder why is intel stock so cheap despite the company’s strategic importance in the semiconductor industry. With Intel shares trading around $24.90 as of September 2025, the stock has gained 23% year-to-date but remains significantly undervalued compared to historical levels, presenting both opportunities and risks for potential investors.

Current Intel Stock Performance and Market Position

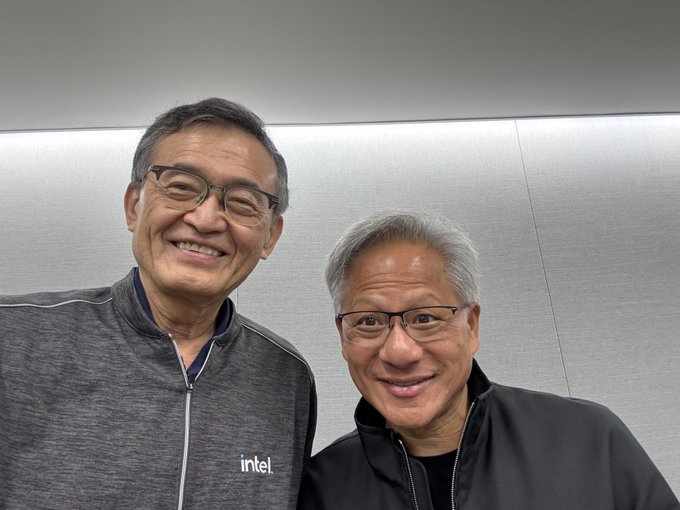

Intel’s stock performance in 2025 tells a story of gradual recovery amid ongoing challenges. The company has navigated through significant turbulence while implementing a comprehensive turnaround strategy under CEO Lip-Bu Tan.

2025 Stock Performance Highlights

Intel shares started the year at $20.22 and have climbed to $24.90, representing a solid 23% gain year-to-date. The stock hit a high of $27.55 in early 2025 before experiencing volatility that brought it to a low of $17.67. This performance stands in stark contrast to competitors like Nvidia and AMD, which have outperformed Intel significantly.

The company’s market capitalization currently sits at approximately $137 billion, with daily trading volumes averaging around 96 million shares. Recent technical analysis shows Intel trading above key support levels, with moving averages indicating bullish momentum despite ongoing fundamental concerns.

Financial Recovery Under New Leadership

CEO Lip-Bu Tan, who took over in March 2025, has implemented aggressive cost-cutting measures and strategic refocusing initiatives. The company reported Q2 2025 revenue of $12.9 billion, exceeding the high end of guidance, though profitability remains challenged by one-time restructuring costs and impairment charges.

Intel’s adjusted earnings per share came in at a loss of $0.10 for Q2 2025, but excluding $800 million in impairment charges and $200 million in one-time costs, the company would have achieved a positive $0.10 EPS. This improvement signals that underlying operations are stabilizing despite headline losses.

Why Is Intel Stock So Cheap: Understanding the Valuation Disconnect

Several interconnected factors explain Intel’s current valuation challenges, creating what many analysts view as either a value trap or a turnaround opportunity.

Market Share Erosion and Competitive Pressures

Intel has lost significant market share to AMD in both consumer and server segments over the past five years. AMD’s superior processor architecture and manufacturing efficiency have allowed it to capture market share in high-margin server markets, while Intel’s struggles with manufacturing process improvements have hindered competitive responses.

The artificial intelligence boom has particularly hurt Intel, as the company lacks competitive offerings compared to Nvidia’s dominant GPU solutions and specialized AI accelerators. This technological gap has left Intel largely absent from one of the semiconductor industry’s fastest-growing and most profitable segments.

Manufacturing and Execution Challenges

Intel’s foundry strategy, despite over $50 billion in investment, has failed to secure significant external customers. The company’s SEC filing acknowledges uncertainty about obtaining notable external foundry clients for its Intel 14A process node, raising questions about the viability of its contract manufacturing ambitions.

Manufacturing execution problems have compounded these issues. Intel’s revenue declined from $79 billion in 2021 to an estimated $53 billion in 2024, reflecting both market share losses and overall demand weakness in traditional PC markets.

Financial Performance and Profitability Concerns

Intel posted one of its largest historical losses in 2024, with net losses of $18.76 billion driven by massive impairment charges and restructuring costs. The company suspended its dividend for the first time since 1992, ending a 32-year streak that made it attractive to income investors.

Operating margins have compressed significantly due to competitive pricing pressure and high capital expenditures for foundry development. The company’s current P/E ratio reflects these profitability challenges, with forward earnings estimates remaining modest despite recent operational improvements.

Government Support and Strategic Importance

Intel’s strategic importance to U.S. national security has resulted in unprecedented government support through the CHIPS Act and direct equity investment.

CHIPS Act Funding and Government Equity Stake

The U.S. government has committed $11.1 billion in total funding to Intel, including $8.9 billion in equity investment announced in August 2025. This represents approximately 9.9% of Intel’s equity, demonstrating the government’s commitment to maintaining domestic semiconductor manufacturing capabilities.

The CHIPS Act funding comes with specific requirements, including restrictions on expanding operations in certain countries and limitations on dividend payments and stock buybacks. These conditions ensure that government support directly benefits domestic manufacturing expansion rather than shareholder returns.

National Security Implications

Intel remains the only U.S. company capable of leading-edge logic semiconductor design and manufacturing. This unique position makes the company strategically vital for national security applications, defense systems, and reducing dependence on foreign semiconductor suppliers.

The government’s equity stake provides downside protection for investors while ensuring Intel’s continued operation as a domestic semiconductor champion. This support effectively reduces bankruptcy risk and provides stability during the turnaround process.

Intel Stock Price Prediction 2025: Analyst Forecasts and Price Targets

Wall Street analysts remain cautiously optimistic about Intel’s near-term prospects, though price targets reflect ongoing uncertainty about execution risk.

Consensus Analyst Outlook

Based on 28-29 analysts covering Intel, the consensus rating is “Hold” with an average 12-month price target of $22.17-$22.20. Price targets range from a low of $14 to a high of $28, reflecting significant disagreement about Intel’s prospects.

| Analyst Firm | Rating | Price Target | Key Reasoning |

| Jefferies | Hold | $22.00 | Improved discipline but challenges remain |

| Citi | Neutral | $21.00 | Turnaround uncertainty persists |

| HSBC | Hold | $23.00 | “Uninspiring” performance and outlook |

| J.P. Morgan | Underweight | $20.00 | Limited foundry customer traction |

Technical Analysis and Short-Term Outlook

Technical indicators show mixed signals for Intel stock. Moving averages suggest bullish momentum in the short term, with the stock trading above its 20-day and 50-day moving averages. However, longer-term indicators remain cautious due to fundamental challenges.

Resistance levels exist around $27-$28, corresponding to 2025 highs, while support appears strong around $22-$23 based on recent trading patterns. Volume patterns suggest institutional interest but limited conviction in the current rally.

Long-Term Investment Thesis and Risk Factors

Intel’s investment case depends heavily on successful execution of its turnaround strategy and ability to regain competitive positioning.

Bull Case for Intel Stock

The optimistic scenario for Intel centers on successful technology development and foundry customer acquisition. Key factors supporting higher valuations include:

Process Technology Recovery: Intel’s “five nodes in four years” roadmap aims to regain manufacturing leadership by 2025-2026. Success with Intel 18A could restore competitive advantages and improve margins.

Foundry Success: Securing major external customers like Microsoft for Intel 18A manufacturing could validate the foundry strategy and generate significant revenue. The potential lifetime value of such contracts could reach $15 billion or more.

AI PC Adoption: Rising artificial intelligence PC adoption from 5% in 2024 to an estimated 53% by 2026 could benefit Intel’s strong position in PC processors.

Government Support: CHIPS Act funding and the U.S. equity stake provide financial stability and reduced execution risk compared to going it alone.

Bear Case and Downside Risks

The pessimistic outlook for Intel focuses on structural competitive disadvantages and execution risk:

Continued Market Share Loss: AMD’s technological advantages in both consumer and server markets could persist, further eroding Intel’s revenue base and profitability.

Foundry Execution Risk: Failure to secure significant Intel 14A customers could force closure or scaling back of advanced manufacturing operations, representing a sunk cost of over $50 billion.

Financial Stress: Negative free cash flow, compressed margins, and high capital requirements could strain the balance sheet despite government support.

Competitive Obsolescence: Rapid industry evolution toward specialized AI chips and ARM-based architectures could make Intel’s x86 dominance increasingly irrelevant.

Investment Strategy and Recommendations

Intel represents a high-risk, high-reward turnaround play that requires careful consideration of individual risk tolerance and investment timeline.

For Value Investors

Intel’s current valuation metrics suggest potential upside for patient investors willing to wait 2-3 years for turnaround execution. The government equity stake provides downside protection, while successful foundry development could drive significant appreciation.

Conservative investors should consider dollar-cost averaging into positions rather than making large initial commitments, given the uncertainty around execution timelines and competitive responses.

For Growth Investors

Intel lacks the growth characteristics typically sought by growth-oriented investors. The company’s revenue has declined significantly, and even successful turnaround execution would likely result in modest growth rates compared to other technology opportunities.

Growth investors might consider Intel only as a small speculative position within a diversified technology portfolio, recognizing the low probability of spectacular returns.

Risk Management Considerations

Intel investment requires careful position sizing due to execution risk and competitive uncertainty. Key risk factors include:

- Technology Execution: Delays or failures in process development could extend the turnaround timeline

- Customer Acquisition: Foundry success depends on attracting external customers in a competitive market

- Market Evolution: Industry shifts toward specialized computing could reduce Intel’s addressable market

- Capital Requirements: Continued high capex needs could strain cash generation and limit shareholder returns

Economic and Industry Context for 2025

Broader semiconductor industry trends and economic conditions will significantly influence Intel’s performance through 2025.

Semiconductor Cycle Recovery

The semiconductor industry is emerging from a cyclical downturn that began in late 2022. PC and server demand recovery could benefit Intel’s core markets, though the company faces intensified competition from established players and new entrants.

AI-driven demand for specialized semiconductors continues growing rapidly, but Intel’s limited participation in this segment constrains its ability to benefit from industry growth trends.

Geopolitical Factors

U.S.-China trade tensions and national security concerns support Intel’s domestic manufacturing strategy. Government policies favoring domestic chip production create tailwinds for Intel’s foundry ambitions while potentially limiting competitive pressure from Asian manufacturers.

FAQs

What is Intel’s current stock price and how has it performed in 2025?

Intel stock is trading around $24.90 as of September 18, 2025, representing a 23% gain year-to-date from its starting price of $20.22. The stock reached a high of $27.55 and a low of $17.67 during 2025.

Why is Intel stock considered cheap compared to other tech stocks?

Intel stock appears cheap due to several factors: significant market share losses to AMD, failed execution in AI markets dominated by Nvidia, foundry strategy struggles despite $50+ billion investment, and financial losses including $18.76 billion in net losses for 2024. The company also suspended its dividend for the first time since 1992.

What is the consensus analyst price target for Intel stock?

Wall Street analysts have a consensus “Hold” rating with an average 12-month price target of $22.17-$22.20 based on 28-29 analysts. Price targets range from $14 (low) to $28 (high), reflecting significant disagreement about Intel’s prospects.

How does government support affect Intel’s investment outlook?

The U.S. government has invested $11.1 billion in Intel through CHIPS Act funding and direct equity stakes, representing 9.9% ownership. This provides downside protection, reduces bankruptcy risk, and supports Intel’s strategic importance for national security, making it a more stable turnaround play.

What are the main risks for Intel investors in 2025?

Key risks include continued market share erosion to competitors, potential failure of the foundry strategy if external customers aren’t secured, ongoing financial stress with negative free cash flow, and industry evolution toward AI and ARM-based architectures where Intel has limited presence.

Should investors buy Intel stock as a turnaround play?

Intel represents a high-risk, high-reward turnaround opportunity suitable for patient investors with higher risk tolerance. The government equity stake provides some downside protection, but successful execution over 2-3 years is required for significant returns. Conservative investors might consider dollar-cost averaging, while growth investors should limit position sizes due to execution uncertainty.

The intel stock price prediction 2025 ultimately depends on management’s ability to execute the turnaround strategy while navigating intense competitive pressure. Understanding why is intel stock so cheap provides insight into both the risks and potential rewards of investing in this semiconductor giant during its critical transformation phase.

Read more article please click on the Link.