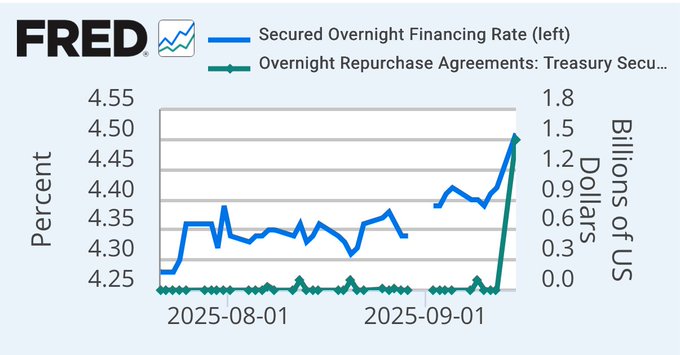

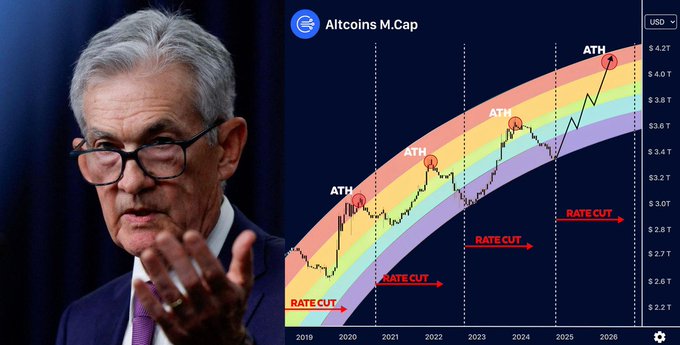

The Federal Reserve has signaled its first fed rate cuts 2025, with policymakers widely expected to reduce the federal funds rate by 25 basis points at the fed meeting september 2025. This move comes amid softening job growth, persistent inflation pressures, and heightened political scrutiny surrounding the Fed’s independence.

Why the Fed Is Cutting Rates in 2025

Recent data show that the labor market is cooling, with August adding just 22,000 jobs—well below forecasts—while the unemployment rate ticked up to 4.3%. At the same time, inflation remains above the Fed’s 2% target, partly driven by recent tariffs. Balancing these pressures, Fed Chair Jerome Powell emphasized the Fed’s dual mandate of maximum employment and stable prices, noting that risks to employment have shifted the outlook toward easing.

What to Expect from the September Fed Meeting

The federal reserve meeting on September 16–17 will culminate in a statement at 2 p.m. ET, followed by a press conference at 2:30 p.m. ET. Market consensus is for a 0.25% cut, lowering the target range to 4.00%–4.25% from 4.25%–4.50%. FedWatch probabilities show a 96% chance of this quarter-point reduction, with only a 4% chance of a larger 50 basis point cut.

Key Announcement Highlights

- New target federal funds rate: 4.00%–4.25%

- Press conference with Jerome Powell at 2:30 p.m. ET

- Updated Summary of Economic Projections

- Guidance on potential additional cuts in October and December

How Rate Cuts Impact Americans Today

A rate cut by the Fed typically lowers interest rates today on variable-rate loans and credit products. For homeowners with adjustable-rate mortgages, monthly payments could decline modestly. Consumers may also see slight drops in credit card and auto loan rates as banks pass through reduced borrowing costs, though fixed mortgage rates depend on long-term Treasury yields.

| Loan Type | Current Impact | Expected Post-Cut Change |

| Adjustable-rate mortgage | Higher payments under 4.33% EFFR | Payments ease under 4.00%–4.25% |

| Credit cards | Rates tied to prime (7.50%) | Prime may drop to ~7.25% |

| Auto loans | Averaging 6.0%–7.0% nationwide | Slight dip in new offers |

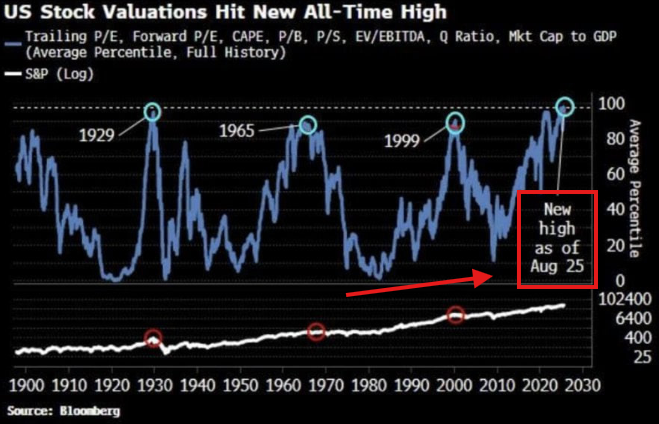

Fed Rate Cuts in Historical Context

This expected fed rate cuts move would mark the first reduction since December 2024. Historically, the Fed has cut rates to cushion downturns—most recently at the onset of the 2020 pandemic and during the 2008 financial crisis. In 2025, the Fed’s cautious pivot reflects concerns over labor market fragility and tariff-driven inflation.

What Comes Next After September

Policymakers have dotted their calendar with fed meetings on October 29 and December 10. Economists forecast one or two more quarter-point cuts by year-end if job growth remains sluggish and inflation cools toward 2%. Market participants will watch Fed communications closely for any shift in pace or size of future cuts.

Table: Projected Fed Funds Rate Trajectory in 2025

| Meeting | Date | Expected Change | Rate Range (%) |

| September 2025 | Sept 17 | –0.25% | 4.00 – 4.25 |

| October 2025 | Oct 29 | –0.25% (likely) | 3.75 – 4.00 |

| December 2025 | Dec 10 | –0.25% (possible) | 3.50 – 3.75 |

Why This Matters for USA Readers

- Borrowers can lock in lower rates on large purchases or refinancing.

- Investors may see equity markets rally on easier monetary policy, though volatility can follow.

- Savers face persistently low yields on savings accounts and CDs, heightening the search for higher returns elsewhere.

FAQs

What exactly happens at a Fed meeting?

The Federal Open Market Committee reviews economic data, votes on a target federal funds rate, issues a statement, and—if scheduled—hosts a press conference. The fed meeting today on September 17 will include updated economic projections outlining expected GDP growth, unemployment, and inflation.

How much will mortgage rates drop after the rate cut?

Adjustable-rate mortgage payments typically follow the federal funds rate with a short lag. Borrowers could see monthly payments decrease by 5–15 basis points, depending on their lender’s pass-through.

Could the Fed reverse course and raise rates again in 2025?

While unlikely in 2025 given current economic signals, the Fed remains data-dependent. A sudden surge in inflation above 3% or strengthening job growth could prompt a pause or even a tightening pivot.

Who influences Fed decisions besides Jerome Powell?

The Fed’s dual mandate is interpreted by the 12-member FOMC, which includes regional Fed bank presidents and governors. Political leaders can voice opinions, but the Fed’s independence is protected by statute.

How can I prepare financially for these rate cuts?

Consider refinancing variable-rate debt, reviewing investment allocations for rate-sensitive sectors (e.g., utilities, real estate), and exploring higher-yield savings alternatives to offset low deposit rates.

By understanding the dynamics of fed rate cuts 2025, federal reserve interest rates, and upcoming FOMC decisions, USA readers can navigate changing borrowing costs, investment landscapes, and economic outlooks with confidence.

Read more articles please click on the Link.