The “fed meeting” this month is one of the top financial stories in the USA as investors, policymakers, and households watch the Federal Reserve’s every move. Key terms like fed meeting, FOMC, fed meeting today, fed rate decision, FOMC meeting, interest rates, FOMC meeting today, fed, and interest rates today are trending, reflecting widespread anticipation in advance of the Federal Open Market Committee’s policy announcement.

- What Is the Fed Meeting and Why Does It Matter?

- July 2025 FOMC Meeting: Dates and What Was at Stake

- Fed Rate Decision Today: What Did the FOMC Do?

- Highlights from the July 2025 Fed Decision

- Why Did the Fed Hold Rates Steady?

- Market Expectations and Future Outlook

- Mortgage, Savings, and Loan Rates Today

- Why Does the Fed Meeting Move Markets?

- Summary Table: FOMC Meeting Calendar – 2025

- Key Takeaways and Why It Matters Now

- Frequently Asked Questions: Fed Meeting, Rates & Today’s Impact

- Final Thoughts

What Is the Fed Meeting and Why Does It Matter?

A Fed or FOMC meeting refers to the scheduled gathering of the U.S. Federal Reserve’s policymaking body, the Federal Open Market Committee, typically held eight times a year. At each meeting, the committee assesses the economy and determines monetary policy, specifically the federal funds rate, which influences everything from savings rates to mortgage costs and inflation trends across America.

July 2025 FOMC Meeting: Dates and What Was at Stake

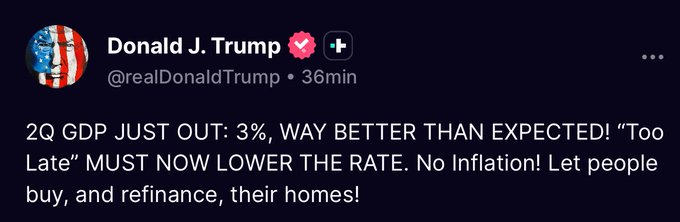

The July 2025 FOMC meeting was held over two days, July 29-30, with the rate decision announced on July 30 at 2:00 pm ET (11:30 pm IST). The meeting was closely watched because U.S. inflation has remained above target, consumer spending slowed, and labor market gains began to cool. Adding political drama, President Trump urged the Fed to slash rates sharply, intensifying headlines around the fed rate decision.

Fed Rate Decision Today: What Did the FOMC Do?

Regardless of the significant lobbying by the White House, the FOMC decided to keep the federal funds rate at its current position for the fifth consecutive gathering. The current target range remains 4.25%–4.50%, a historically high level designed to keep inflation in check. There was lively internal debate—unusual compared to past years—showing just how challenging economic signals are in 2025.

Highlights from the July 2025 Fed Decision

- Federal Funds Target Rate: 4.25%–4.50% (no change)

- Statement Theme: Cautious—acknowledged slowing job growth, steady inflation above target, and rising debt delinquencies

- Mortgage rates today: 30-year fixed averages 6.69% nationwide

- CD and Savings Rates: Best savings and CD rates remain between 4.3–4.5%

Key Table: Fed Meeting – July 2025 Outcome and Data

| Meeting Dates | Rate Decision | Target Fed Funds Rate | Inflation Rate (June 2025) | Mortgage Rate (30yr, avg) |

| July 29–30, 2025 | Held Steady | 4.25%–4.50% | 2.7% | 6.69% |

Why Did the Fed Hold Rates Steady?

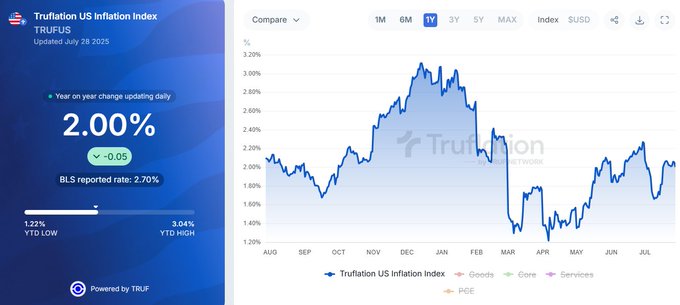

Fed Chair Jerome Powell and the FOMC are balancing mixed signals. While job growth has decelerated and consumer spending is soft, inflation—driven partly by higher tariffs and lingering supply bottlenecks—is still well above their 2% annual target. The FOMC’s priority remains lowering inflation without tipping the economy into recession, so the committee opted to leave rates unchanged for now.

Market Expectations and Future Outlook

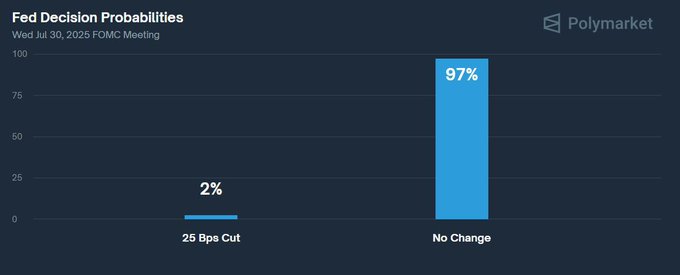

Wall Street and global markets had largely priced in a “hold” at the July 2025 fed meeting, but attention turned swiftly to the press conference for hints about September policy. According to futures markets, there’s about a two-thirds probability the Fed will cut rates by 0.25 percentage points in September, with some experts forecasting two total cuts before the end of 2025. Powell’s post-meeting briefing provided no firm commitment, emphasizing data dependence and economic uncertainty.

Mortgage, Savings, and Loan Rates Today

Interest rates today, as shaped by the Fed’s policy, play a central role in the daily finances of Americans:

- 30-year fixed mortgage: Average 6.69%

- 15-year fixed mortgage: About 5.89%

- Top CD rates (6–9 month): 4.4–4.5%

- Bank prime loan rate: 7.50%

- Best savings account rates: 4–5%

Why Does the Fed Meeting Move Markets?

Whenever the fed or FOMC changes interest rates, it directly affects bank lending, mortgages, savings yields, and currency values. Even the words in the official statement and press conference can spark moves in the stock market, bond yields, and global exchange rates.

Summary Table: FOMC Meeting Calendar – 2025

| Meeting Dates | Noteworthy Outcome |

| Jan 28–29 | Held rates steady |

| Mar 18–19 | Held rates steady |

| May 6–7 | Held rates steady |

| Jun 17–18 | Held rates steady |

| Jul 29–30 | Held rates steady |

| Sep 16–17 | Next meeting; possible rate cut forecast |

| Oct 28–29 | Scheduled |

| Dec 9–10 | Scheduled |

Key Takeaways and Why It Matters Now

- During the July 2025 meeting, the Federal Reserve kept the key policy rate steady at 4.25%–4.50%. No rate cut, but more FOMC dissent than in years past.

- Global markets are watching closely for signs of a possible Fed rate cut in September.

- U.S. inflation (CPI) stands at 2.7%, above the stated target.

- Mortgage rates and savings yields remain elevated, benefiting savers but challenging borrowers.

- The upcoming FOMC meeting, scheduled for September 16–17, is drawing interest due to a possible shift.

Frequently Asked Questions: Fed Meeting, Rates & Today’s Impact

Q: What is the main outcome from the fed meeting today?

A: The FOMC kept the federal funds rate unchanged at 4.25%–4.50%; the focus shifted to Jerome Powell’s comments about potential future rate cuts.

Q: What are current interest rates today?

A: The fed funds target rate is 4.25%–4.50%, with the best 30-year fixed mortgage averaging 6.69%, and top savings account rates around 4–5%.

Q: Why did the FOMC not cut rates?

A: With inflation still above the target and mixed jobs and spending data, the Fed opted to hold rates steady for now and reassess at the September meeting.

Q: When is the next Fed meeting?

A: The next FOMC meeting is scheduled for September 16–17, 2025.

Q: How can I watch the press conference?

A: The FOMC’s press conference was live-streamed on the Federal Reserve’s YouTube channel, its official website, and X (which was formerly known as Twitter).

Final Thoughts

The July 2025 fed meeting was a crucial checkpoint for the U.S. economy, keeping interest rates steady as the nation faces persistent inflation and global challenges. Whether you’re tracking the fed meeting, FOMC, fed rate decision, interest rates today, or planning for your finances, staying current with these events helps you anticipate trends and prepare for what’s next in a changing economic landscape.

Read more article please click on the Link.